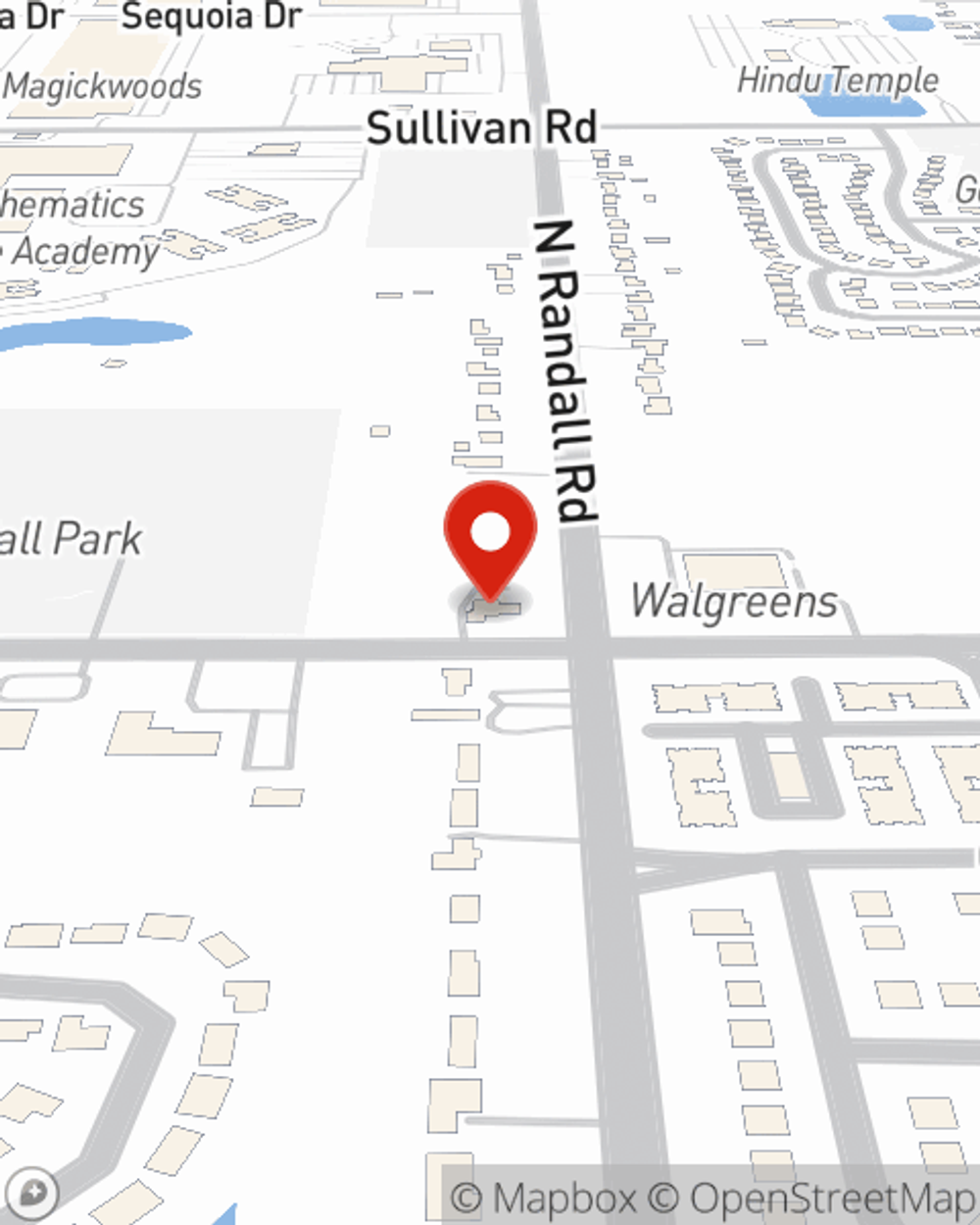

Homeowners Insurance in and around Aurora

Protect what's important from the unanticipated.

Help cover your home

Would you like to create a personalized homeowners quote?

There’s No Place Like Home

One of the most important steps you can take for your loved ones is to get homeowners insurance through State Farm. This way you can kick back knowing that your home is taken care of.

Protect what's important from the unanticipated.

Help cover your home

State Farm Can Cover Your Home, Too

Rodrigo Menendez will help you feel right at home by getting you set up with secure insurance that fits your needs. Protection for your home from State Farm not only covers the structure of your home, but can also protect precious items like your mementos.

Don’t let fears about your home make you unsettled! Reach out to State Farm Agent Rodrigo Menendez today and discover how you can meet your needs with State Farm homeowners insurance.

Have More Questions About Homeowners Insurance?

Call Rodrigo at (630) 981-0101 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Rodrigo Menendez

State Farm® Insurance AgentSimple Insights®

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.